Gap Loan Financing Program

The City of Los Angeles Gap Financing Program aims to support equitable economic recovery and revitalization of Los Angeles by assisting real estate projects that provide economic development opportunities via support to businesses and job creation/retention. Forgivable grants and loans are available for qualified projects ranging from $500,000 to $1,500,000.

The Gap Financing Program will fund economic development projects involving the acquisition, new construction, and/or substantial rehabilitation of commercial, industrial, and mixed-use developments (commercial component only). Funded projects will focus on developing:

The Economic and Workforce Development Department seeks to fund qualified and shovel-ready projects to provide economic development and community benefits while ensuring the project is eligible at the program and underwriting levels. Potential projects must start construction within 18 months of the forgivable grant agreement/loan agreement execution to ensure gap financing investment dollars are deployed in a timely manner for maximum community benefit.

The Gap Financing Program will fund economic development projects involving the acquisition, new construction, and/or substantial rehabilitation of commercial, industrial, and mixed-use developments (commercial component only). Funded projects will focus on developing:

Promoting Economic Growth of New Business and Industry

Job Creation and Retention

Diversification of the Los Angeles Economy

The Economic and Workforce Development Department seeks to fund qualified and shovel-ready projects to provide economic development and community benefits while ensuring the project is eligible at the program and underwriting levels. Potential projects must start construction within 18 months of the forgivable grant agreement/loan agreement execution to ensure gap financing investment dollars are deployed in a timely manner for maximum community benefit.

Is Your Project a Candidate?

Do any of these questions apply to your proposed project?

If you answer "YES" to most of these questions, your project might be a good candidate for gap financing. For additional information, please fill out EWDD's Loan Program Intake Form so that we can better assist you!

- Is the proposed project within the City of Los Angeles boundaries?

- Is the proposed project commercial, industrial, or mixed-use?

- Has the proposed project received all entitlements and permits?

- Will the proposed project start construction within 18 months of loan approval?

- Has the proposed project received all funding commitments?

- Has the proposed project a confirmed funding gap that is no more than $1.5 million?

- Will the funds be used for construction, rehabilitation, equipment, relocation, and indirect or soft costs associated with these activities?

- Will the proposed project create/retain jobs or provide needed goods/services to low- and moderate-income residents?

What is Gap Financing?

A “funding gap” is the difference between the cost of a project and the committed funding sources. Also referred to as bridge or interim financing, gap financing is a short-term loan to meet an immediate financial obligation until a longer-term financial loan can be secured. EWDD offers this type of financing for commercial projects, industrial projects, and the commercial or industrial portion of mixed-use projects.

Types of eligible recipients include partnerships, corporations, sole proprietorships, public agencies, and non-profits with a demonstrable record of operations.

Types of eligible recipients include partnerships, corporations, sole proprietorships, public agencies, and non-profits with a demonstrable record of operations.

Evaluation Criteria

The goal of the Gap Financing Program is to support the equitable economic recovery and revitalization of Los Angeles by assisting real estate projects that provide economic development opportunities via support to businesses and job creation/retention.

Potential projects must be shovel ready, meet CDBG Program Underwriting requirements, and must be located within the City of Los Angeles. Use the LA City Neighborhood Info Tool to determine the location of your business or development project.

Potential projects must be shovel ready, meet CDBG Program Underwriting requirements, and must be located within the City of Los Angeles. Use the LA City Neighborhood Info Tool to determine the location of your business or development project.

Eligibility

Eligible Activities

- Land Acquisition

- Off-site or on-site improvements

- Building construction/renovation/expansion

- Clearance and demolition

- Parking facilities

- Purchase or long-term lease of equipment

- Relocation

- Interior and/or exterior rehabilitation, restoration or alteration of commercial properties-leasehold, seismic, or other improvements

- Purchase of commercial property for expansion of an on-going business

- Indirect or soft costs associated with the above activities

Funding Requirements

Community Development Block Grants (CDBG). All projects must meet at least one National Objective:

- Benefit to low-and moderate income (LMI) persons;

- Aid in the prevention of slums or blight; or

- Meet an urgent need

Contact

If you are interested in applying for one of EWDD's loan programs, please fill out EWDD's Loan Program Intake Form so that we can better assist you! EWDD BusinessSource Centers are also able to assist with more information and in preparing applications. Centers are located throughout the city - find the center closest to you!

BusinessSource Center Locations:

-

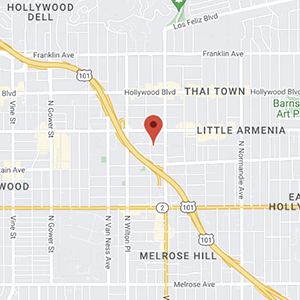

Hollywood

1370 North St. Andrews Place, #215

1370 North St. Andrews Place, #215

Los Angeles 90028

213-989-3158

213-989-3158

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Pacific Asian Consortium in Employment (PACE)

Pacific Asian Consortium in Employment (PACE)

English, Korean, Thai, Mandarin, Cantonese, Tagalog, Español, Armenian, Farsi

English, Korean, Thai, Mandarin, Cantonese, Tagalog, Español, Armenian, Farsi

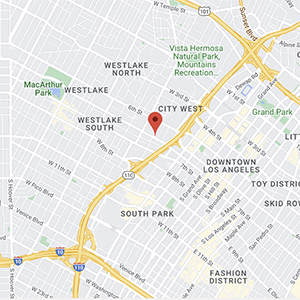

Pico-Union/Westlake

1055 Wilshire Boulevard, #900-B

1055 Wilshire Boulevard, #900-B

Los Angeles 90017

213-353-9400

213-353-9400

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Pacific Asian Consortium in Employment (PACE)

Pacific Asian Consortium in Employment (PACE)

English, Spanish, Korean, Mandarin, Cantonese, French, Lingala, Tagalog, Thai, Armenian, Farsi, Hindi, Kanada, Gujrati, Marathi, Punjabi

English, Spanish, Korean, Mandarin, Cantonese, French, Lingala, Tagalog, Thai, Armenian, Farsi, Hindi, Kanada, Gujrati, Marathi, Punjabi

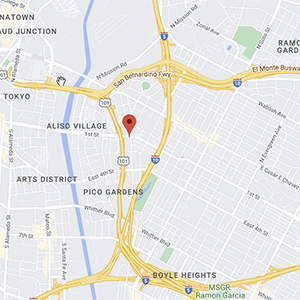

East Los Angeles

1780 East First Street

1780 East First Street

Los Angeles 90033

323-568-1520

323-568-1520

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

New Economics for Women

New Economics for Women

English, Spanish

English, Spanish

-

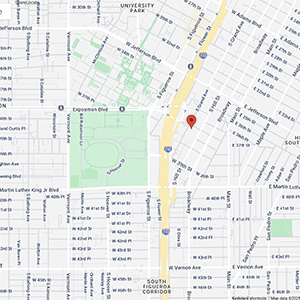

Southeast Los Angeles

3761 South Hill Street, Unit 1

3761 South Hill Street, Unit 1

Los Angeles 90007

323-450-7226

323-450-7226

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Coalition for Responsible Community Development (CRCD)

Coalition for Responsible Community Development (CRCD)

English, Spanish

English, Spanish

South Los Angeles

3761 South Hill Street, Unit 1

3761 South Hill Street, Unit 1

Los Angeles 90007

*South LA BSC services will be temporarily provided at the Southeast LA location until a permanent office is secured*

323-450-7226

323-450-7226

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Coalition for Responsible Community Development (CRCD)

Coalition for Responsible Community Development (CRCD)

English, Spanish

English, Spanish

Watts

390 West 7th Street

390 West 7th Street

San Pedro 90731

*Watts BSC services will be temporarily provided at the Harbor location until a permanent office is secured*

310-221-0644

310-221-0644

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Managed Career Solutions (MCS)

Managed Career Solutions (MCS)

English, Spanish

English, Spanish

-

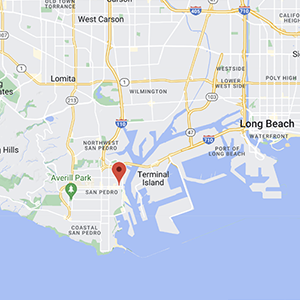

San Pedro, Harbor

390 West 7th Street

390 West 7th Street

San Pedro 90731

310-221-0644

310-221-0644

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Managed Career Solutions (MCS)

Managed Career Solutions (MCS)

English, Spanish

English, Spanish

-

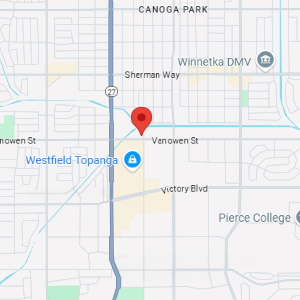

West Valley

6800 Owensmouth Ave, Suite 150

6800 Owensmouth Ave, Suite 150

Canoga Park 91303

747-265-6201

747-265-6201

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Managed Career Solutions (MCS)

Managed Career Solutions (MCS)

English, Spanish

English, Spanish

South Valley

5805 Sepulveda Blvd, Suite 801

5805 Sepulveda Blvd, Suite 801

Van Nuys 91411

818-616-4118

818-616-4118

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Initiating Change in our Neighborhoods (ICON)

Initiating Change in our Neighborhoods (ICON)

English, Spanish

English, Spanish

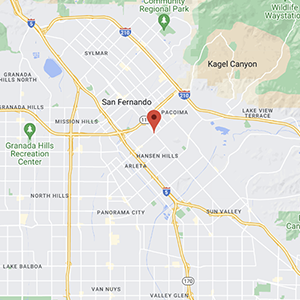

North Valley

13168 Van Nuys Blvd

13168 Van Nuys Blvd

Pacoima 91331

818-302-6114

818-302-6114

711 for TRS

711 for TRS

This email address is being protected from spambots. You need JavaScript enabled to view it.

Initiating Change in our Neighborhoods (ICON)

Initiating Change in our Neighborhoods (ICON)

English, Spanish

English, Spanish

return to Financing Programs